Table of Contents

"Our fleet is only worth how much now?!" Chip screeched into his phone to Sue from accounting.

"Well, sir, commercial vehicles, though an investment or no matter how high the quality, are a depreciating asset," Sue replied. "The second they drive off the sales lot, loose change may as well be falling out of the exhaust pipe."

"So, you're telling me that this new fleet of trucks we just bought has already dropped in price?" Chip huffed.

"Well, yeah. But there is an upside," Sue started in a reassuring tone, "depreciation is tax-deductible."

With that bit of news, Chip's blood pressure lowered a few points. He realized just how little he knew about the various sides of commercial vehicler depreciation.

And it's true.

From the moment a shiny new van or semi-truck drives off the lot, it begins to lose value. This is an unavoidable truth in the world of commercial vehicles. Depreciation can be complex, intertwining with tax codes and financial strategies, but comprehending it offers control over financial outcomes.

In this comprehensive guide, we'll delve into what commercial vehicle depreciation entails, how to calculate it, its tax implications, and strategies to maximize benefits. You'll learn to navigate depreciation methods, understand deduction limits, and optimize your assets for a healthier bottom line.

Quick disclaimer: This guide is meant to help you better understand commercial vehicle depreciation, not to sub as your tax accountant. Always confirm details with a trained professional.

Commercial vehicle depreciation refers to the gradual decrease in a work vehicle's value over time. For business owners, depreciation is also an accounting process—officially accounting for a vehicle's wear and tear, age, and use in a company's financial records— allowing businesses to deduct the cost of the vehicle over its useful life, resulting in potential tax benefits.

In other words, big work vehicles, like trucks, get worn out and lose value over time. This is called depreciation. Businesses keep track of this wear and tear in their records. This helps them save money on taxes by spreading out the cost of the truck over several years.

And there are several different ways to determine depreciation for tax purposes.

Calculating the depreciation of a commercial vehicle involves determining the initial cost, estimating the useful lifespan of the vehicle, and selecting an appropriate method to reflect its diminishing value over time.

The depreciation calculation begins with the purchase price of the vehicle. The vehicle’s purchase price includes not only the base cost but also any additional charges necessary for readying the vehicle for business purposes. The Internal Revenue Service (IRS) often updates dollar limits for depreciation and other relevant guideline figures, making it necessary for businesses to stay informed to calculate depreciation accurately.

The actual expense method and the standard mileage rate are two primary ways businesses can calculate vehicle expenses, including depreciation. With the actual expense method, expenses like depreciation, gas, insurance, and maintenance are precisely tracked.

On the other hand, the standard mileage rate offers a simplified cents-per-mile calculation—though it must be adhered to from the first year a vehicle is used for business.

But there are a few ways businesses can choose to calculate depreciation.

One common method for calculating this depreciation is the Straight-Line Depreciation, which subtracts an estimated salvage value from the vehicle's purchase price. This value is then yearly divided over the period the vehicle is expected to serve the business.

For instance, if a commercial truck is purchased at $50,000 and estimated to last for ten years, the straight-line depreciation would be $5,000 per year, assuming no salvage value.

Businesses can also take advantage of tax deductions through mechanisms like the Section 179 deduction. With this, companies can write off the entire cost of eligible vehicles, focusing on those used more than 50% for business purposes.

This deduction has its limits. For heavy vehicles, for instance, the deduction limit is $25,000.

It's imperative for businesses to fully comprehend commercial vehicle depreciation, as it impacts financial planning and taxable income. Meticulous accounting ensures maximum tax benefits and aids in managing the fleet's lifecycle efficiently.

Several factors should be considered when calculating depreciation for commercial vehicles:

- The vehicle's cost basis: This is the purchase price plus any additional expenses to prepare the vehicle for business use.

- Useful life of the vehicle: Under IRS guidelines, this is typically five years for commercial vehicles.

- Salvage value: If applicable, an estimated value of the vehicle at the end of its useful life.

- Percentage of business use: To qualify for depreciation, the vehicle must be used at least 50% of the time for business purposes.

- Depreciation method chosen: This will affect the rate at which the vehicle's value is reduced each year for tax purposes.

- Vehicle weight rating: Some larger vehicles may be subject to special rules concerning depreciation.

- Bonus depreciation and Section 179 expensing: Current tax laws may allow for accelerated depreciation or immediate expensing under certain conditions.

The primary methods of calculating depreciation for commercial vehicles are:

- Straight-Line Depreciation: As mentioned earlier, this method spreads the cost evenly over the vehicle's useful life.

- Declining Balance Method: This accelerated method writes off more depreciation in the initial years and less in the subsequent years.

- Bonus Depreciation: Allows businesses to deduct a significant portion of the purchase price of eligible business vehicles in the first year of use.

- Section 179 Deduction: Offers businesses a way to expense the entire cost of the vehicle in the first year, subject to deduction limits and business use percentage.

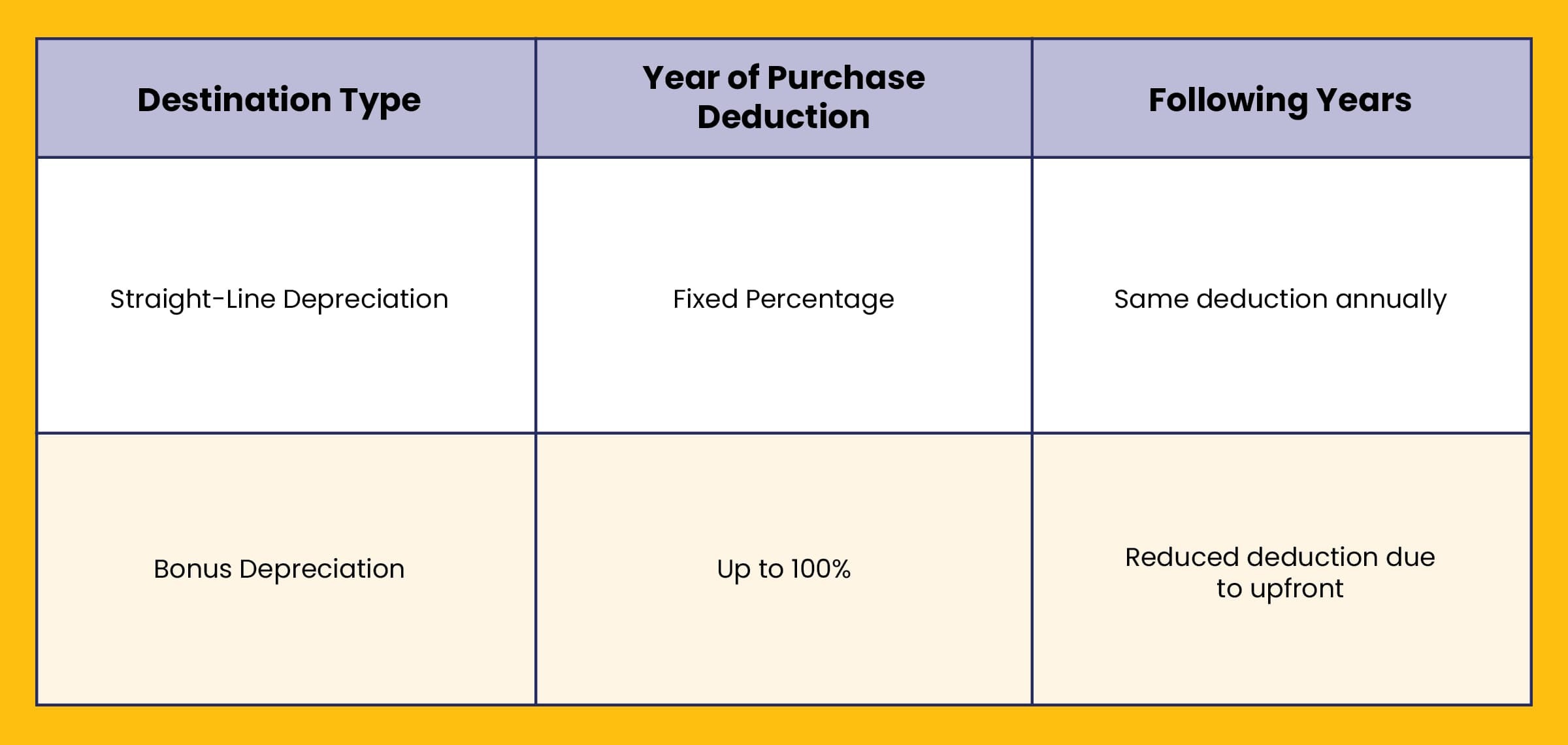

The Straight-Line Depreciation method provides a consistent deduction amount each year, aiding in straightforward financial planning. It is a preferred choice for businesses that prioritize uniform expense allocation over the vehicle's operational lifespan.

Bonus Depreciation, however, allows for an upfront deduction of a large part of the vehicle's cost in the first year itself. This method can reduce taxable income significantly in the year of purchase but leads to smaller depreciation deductions in subsequent years.

When comparing the two, companies must assess their current financial situation, projected income, and how the chosen method impacts long-term tax liability. The decision ultimately hinges on whether immediate tax relief is preferable to steady annual deductions.

Depreciation of commercial vehicles serves as a mechanism for businesses to account for the gradual loss of the vehicle's value over time. On a balance sheet, depreciation reduces the book value of the vehicle annually. But for tax purposes, it's particularly significant—depreciation deductions lower the company's taxable income, leading to potential tax savings.

Understanding the tax implications associated with commercial vehicle depreciation requires knowledge of current tax laws, correct application of deduction methods, and accurate calculation of depreciation amounts.

Each year, a portion of the commercial vehicle's cost is depreciated, and this depreciation can be deducted from a business's earnings to arrive at its taxable income.

In other words, depreciation acts as a non-cash expense that lowers pre-tax income, which in turn decreases the amount of taxes owed. For example, a higher depreciation expense will lead to lower taxable income, assuming all other factors remain the same.

Depreciation deductions for commercial vehicles are taken over the asset's estimated useful life, providing tax relief throughout the period of use.

But tax deduction isn't a one-and-done deal.

When a business purchases a commercial vehicle, it doesn't write off the entire cost immediately—except under certain provisions like Bonus Depreciation or Section 179. Instead, the cost is allocated across multiple tax periods, granting businesses the ability to recover parts of the purchase price gradually—thereby offsetting the cost of acquiring the vehicle against their tax obligations.

The IRS sets forth specific depreciation and deduction limits on commercial vehicles. These limits are updated regularly and can change yearly based on tax laws and inflation adjustments.

Importantly, passenger automobiles have different deduction limits compared to larger commercial vehicles—which may qualify for more significant tax deductions due to their role and utility in business.

For the most accurate deduction limits, always speak to a tax professional—as these are subject to change faster than we can update this guide.

It is crucial for businesses to be aware of and adhere to these limits while filing taxes to avoid errors and possible audits. (Ooh, audits—yikes.)

Vehicles with a gross vehicle weight rating (or GVWR) above a certain threshold are considered "heavy vehicles" and are subject to special tax rules.

These heavy vehicles, including large trucks, box trucks and large cargo vans, may qualify for more generous depreciation deductions because they are typically used extensively for business purposes.

For instance, heavy vehicles may be exempt from the depreciation limits that apply to passenger automobiles and might be fully eligible for the Section 179 deduction or Bonus Depreciation the year the vehicle was purchased, provided that they are used more than 50% of the time for business purposes.

And once again (and you'll probably get tired of hearing this) it's important to refer to the latest IRS guidelines to determine the exact benefits for which a heavy commercial vehicle may qualify.

By taking into account these tax considerations, businesses can accurately calculate commercial vehicle depreciation, maximize their tax benefits, and ensure compliance with IRS regulations.

Maximizing depreciation on commercial vehicles can lead to significant tax savings for businesses. The following are some key strategies to leverage.

Be proactive with tax planning.

Understanding the depreciation schedules and rules for commercial vehicles is essential. Tax planning should begin well before the end of the fiscal year to maximize tax deductions.

Utilize the Modified Accelerated Cost Recovery System (MACRS).

This system allows for a more rapid depreciation at the outset, which can lead to higher deductions in the earlier years of a vehicle's life.

Consider a Cost Segregation Study.

Large, costly commercial vehicles may benefit from a cost segregation study, which can identify and reclassify assets to maximize depreciation deductions.

Keep accurate records.

Proper documentation and record-keeping are vital for supporting depreciation claims, especially in the event of an audit.

By adopting these strategies, businesses can ensure they make the most of the depreciation allowances—staying financially smart with their vehicle investments!

Bonus depreciation is a method that allows businesses to deduct a significant portion of the purchase price of eligible business assets in the year they are placed in service. For commercial vehicles, this can be particularly advantageous.

- The Tax Cuts and Jobs Act allows for 100% bonus depreciation on certain new and used assets acquired and placed in service after September 27, 2017, and before January 1, 2023—(so, check the dates on your vehicle usage!)

- As mentioned before, heavy vehicles, which are often eligible for larger bonus depreciation deductions, can result in immediate tax savings.

- And remember, to qualify depreciation, the commercial vehicle must be used for business purposes more than 50% of the time.

It is critical for businesses to be aware of the current bonus depreciation rules as they can change periodically based on legislative updates.

When it comes to vehicle-related expenses, businesses can choose between two methods:

The Actual Expense Method

The Actual Expense Method allows businesses to deduct the actual costs incurred in operating a vehicle for business purposes, including gas, maintenance, repairs, tires, insurance, registration fees, licenses, and depreciation (or lease payments).

The Standard Mileage Rate

The IRS provides a standard mileage rate (cents per mile) to calculate deductions for a vehicle's business use. Make sure to check the most current rates because they're always subject to change. And trust us—they can change a lot!

Businesses must choose one method and stick to it for the life of the vehicle. Generally, the actual expense method is more beneficial for more expensive commercial vehicles with higher operating costs, while the standard mileage rate might be more advantageous for smaller, more economical vehicles.

Smart timing of commercial vehicle purchases can impact depreciation deductions:

Purchase late in the year.

Buying a vehicle towards the end of the tax year still allows for a full-year's worth of depreciation deductions.

Consider the business usage rate.

Ensure that the vehicle will meet the more-than-50% business use requirement to qualify for certain tax benefits.

Watch the limits.

Be mindful of the dollar limits on depreciation for cars, trucks, and vans for the year the vehicle is placed in service. Checking the latest tax regulations can help in decision-making.

Remember that tables and lists illustrating depreciation schedules, bonus depreciation percentages, or comparison of expense methods can be valuable add-ons to any financial or tax planning guide.

By considering the timing of purchases, the type of vehicle, and the depreciation methods available, businesses can strategically plan for maximum tax benefits.

In the United States, the standard depreciation period for a business car is typically five years under the Modified Accelerated Cost Recovery System (MACRS). However, the IRS rules state that you actually depreciate it over six years. This is because:

- Vehicles are generally treated as being placed in service halfway through the year.

- You claim depreciation for half a year in the first year and half a year in the sixth year.

While 5 years is the standard, there are other methods that allow for faster depreciation that you should speak to a tax professional about.

Important Considerations:

Luxury Car Limits

There are annual depreciation limits on luxury cars. These limits are adjusted for inflation and can change each year.

50% Rule

To use the standard depreciation schedule, the car must be used for business purposes more than 50% of the time. If not, you must use the straight-line depreciation method.

Yes, you can often fully depreciate a vehicle weighing over 6,000-pounds in one year if it's primarily used for business. This is due to bonus depreciation and Section 179 deductions. However, the 2023 bonus depreciation rate will allow for an 80% deduction. It's highly recommended to consult a tax professional because tax laws can be complex and change year to year.

Well, that's hard to answer.

Commercial truck depreciation rates vary greatly depending on the vehicle's initial price, brand, usage, maintenance, and market conditions. Generally, you can expect the most significant depreciation in the first few years, with an average rate potentially ranging from 15%-30% annually. However, this is just an estimate. For accurate figures, use depreciation calculators or consult a tax professional.

For a quick estimate of your commercial truck's depreciation, check out this Truck Depreciation Calculator from Drive Wyze.

However, both the figured above and calculators are just an estimate. For accurate figures, use depreciation calculators or consult a tax professional.

Commercial vehicles are typically depreciated over 5 years using the standard IRS schedule. However, due to how vehicles are placed in service, you'll technically claim depreciation over 6 years (half a year in the first and sixth year). Remember, there are limits on luxury car depreciation and vehicles must be used for business more than 50% of the time to qualify for the standard schedule.

Go Forth and Depreciate!

While it is true that the moment you drive a new vehicle off the lot, it loses a chunk of its value, there's an upside. Tax codes may seem complicated but understanding depreciation methods like Section 179 and bonus depreciation can lead to significant savings for your business. Depreciation is inevitable but it doesn't have to eat away at your bottom line. Always consult a tax advisor to get the latest rules and make sure you're squeezing the most out of the depreciation game.

Your Source for Quality New and Used Commercial Vehicles for Sale

If you're in the market for quality new or used commercial vehicles for sale for your business, your friends from My Little Salesman can help. Since 1958, My Little Salesman has been connecting buyers with sellers of commercial vehicles, heavy equipment, parts, tools, accessories, and anything else needed to get the toughest jobs done. You're invited to shop through listings from sellers all over North America to find the gear you'll like for a price you'll love.